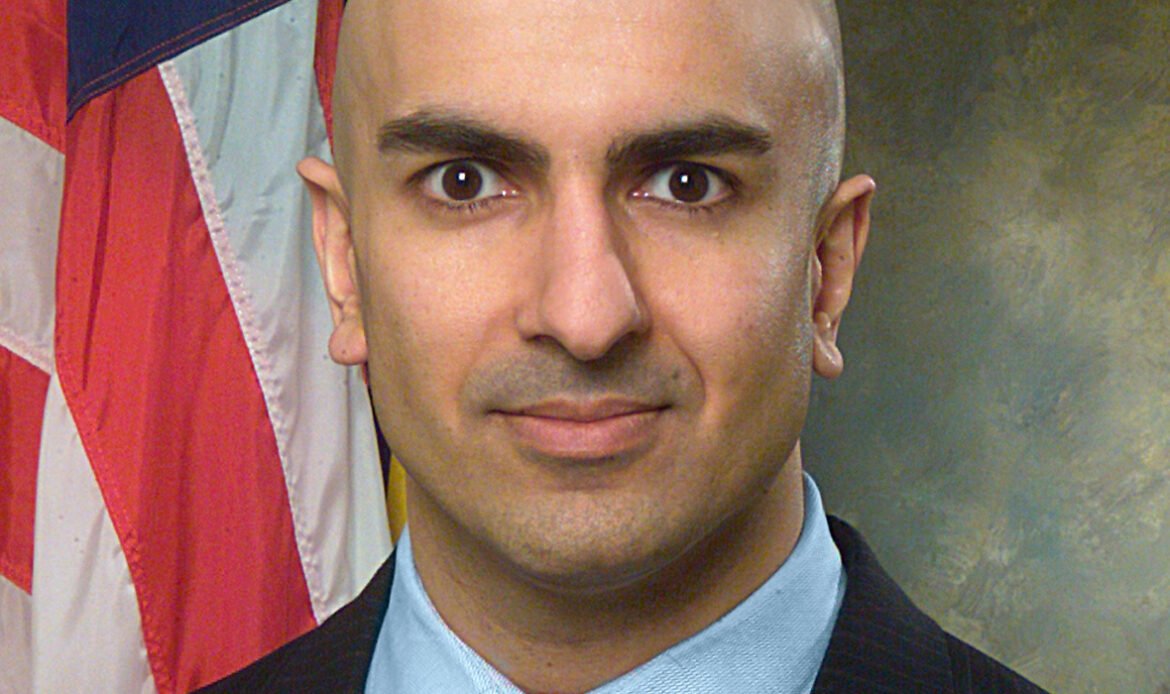

“It definitely brings us closer right now” — that was Minneapolis Fed President Neel Kashkari’s response to a question, during a CBS “Face The Nation” interview, on whether the latest turmoil in the banking sector could bring the U.S. closer to a recession.

“What’s unclear for us is how much of these banking stresses are leading to a widespread credit crunch. And then that credit crunch, just as you said, would then slow down the economy,” he said.

Kashkari added that Fed officials are monitoring the impact from the fallout of the banking sector “very, very closely,” and the current system has the “full support” of the Federal Reserve.

“The banking system has a strong capital position and a lot of liquidity and has the full support of the Federal Reserve and other regulators standing behind it,” he said.

“The U.S. banking system is resilient, and it’s sound,” said Kashkari, when asked about the stability of the banking system’s ability to control further risks seen in California and New York.

Kashkari’s words echoed that of officials at the Financial Stability Oversight Council, which held a closed meeting last week as Fed data showed U.S. customers withdrew nearly $100 billion from banks for the week ended March 15, though this is a tiny fraction of the total.

Separately, sources told CNBC that the movement of deposits from smaller banks to big institutions, such JPMorgan Chase and Wells Fargo, has slowed to a trickle in recent days.

Kashkari described the development as “positive” and a sign of restored faith.

“There are some concerning signs, the positive sign is deposit outflows seem to have slowed down. Some confidence is being restored among smaller and regional banks,” he said.

Too soon to know

Kashkari said it’s too early to predict what any of this means for the next Federal Open Market Committee meeting in May. The Fed raised rates by 25 basis points last week.

“It’s too soon to make any forecasts about the next interest rate meeting that we have, the next FOMC meeting,” he said, adding that the stress in the banking sector would be “the factors that are going to be most focused on.”

He added that banking problems may make it easier for the central bank to achieve its goal of controlling inflation.

“On one hand, such strains could then bring down inflation, so we have to do less work with the federal funds rate to bring the economy into balance,” he said.

“But right now, it’s unclear how much of an imprint these banking stresses are going to have on the economy. But it’s something to watch very carefully,” he added.

‘Safe haven’ Asia

The banking fears in the United States and Europe seem much less pronounced in the Asia-Pacific region, Mark Mobius, founding partner of of Mobius Capital Partners, told CNBC.

“The banks here are much, much more cautious, much more careful, making sure that they have a strong balance sheet,” Mobius said on CNBC’s “Squawk Box Asia” on Monday.

“I think this is in some ways, kind of a safe haven. Banks in Singapore, banks in Thailand and so forth are in pretty good shape,” he said.

Mobius’ comments come after shares of Deutsche Bank fell on Friday, marking a third consecutive day of losses, after the cost of insuring against any default by the German institution spiked.

Over the weekend, International Monetary Fund chief Kristalina Georgieva emphasized that risks to financial stability have increased.

This article was originally published by CNBC.