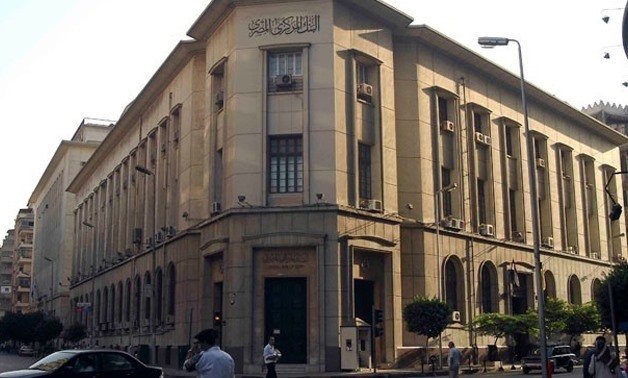

HC Securities and Investment is expecting the Central Bank of Egypt (CBE) to keep interest rates unchanged at its upcoming Monetary Policy Committee (MPC) meeting on July 18th, according to an emailed press release.

The agency attributed this to the slowdown in the annual headline inflation for four consecutive months and the enhanced foreign exchange liquidity resulting from the Ras El-Hekma investment deal.

This is in addition to the country’s one-year credit default swaps (CDS) surging to 303 basis points (bps) now from 857 bps on January 1st.

HC’s forecast for the MPC meeting are also driven by the recent upgrade in Egypt’s credit outlook to positive from negative by Moody’s and to positive from stable by Fitch and S&P.

At its May 23rd meeting, the CBE’s MPC increased the interest rates by 600 bps, while keeping the overnight deposit rate and the overnight lending rate the same at 27.25% and 28.25%, respectively.

Source: Zawya